Understand Your Assessment

Property Valuation Services Corporation (PVSC) is an award winning, independent, not-for-profit organization that is responsible for assessing all property in Nova Scotia.

- Understand Your Assessment

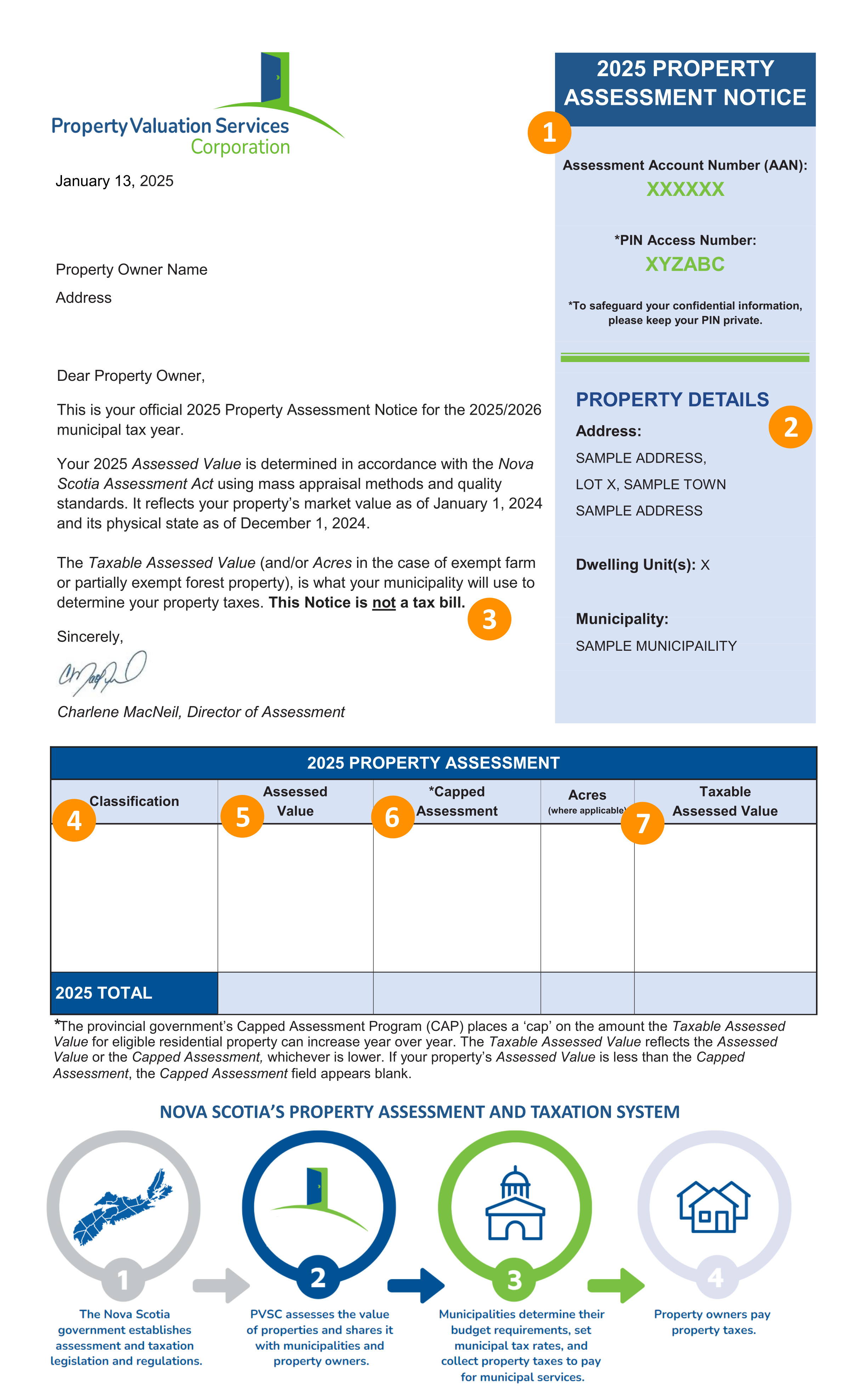

Your Property Assessment Notice

Property Valuation Services Corporation (PVSC) assesses every property in Nova Scotia and mails over 650,000 Property Assessment Notices to property owners every January.

When you get your Property Assessment Notice:

- Read every section.

- Confirm your property details in your online “My Property Report”. You can log in with the Assessment Account Number (AAN) and PIN on your Property Assessment Notice.

- Note the deadline to appeal your assessment. PVSC must receive your appeal within 31 days of the date on your Notice.

- Contact PVSC if you have questions about, or disagree with, your Property Assessment Notice.

- 2025 Property Assessment Notice: You can view detailed information about your property by accessing your "My Property Report" using the Assessment Account Number (AAN) and PIN Number on your Assessment Notice.

- Property Details: This is the physical location of your property.

- This is not a tax bill: This is your 2025 Property Assessment Notice. Your tax bill is mailed separately by your municipality.

- Classification: All property is classified into one of three possible classes: Residential, Resource or Commercial. Classification is based on a property's use or intended use, and whether it meets the requirements for the class as specified by the Nova Scotia Assessment Act. Properties with more than one use may fall into more than one classification. In this case, a share of the value is attributed to each class.

- Assessed Value: The assessed value reflects the physical state of your property as of December 1, 2024, and is based on its market value as of January 1, 2024.

- Capped Assessment: The provincially legislated Capped Assessment Program (CAP) places a 'cap' on the amount that taxable residential property assessments can increase year over year. If your property meets the eligibility criteria for the CAP, it will be reflected on your Notice.

- Taxable Assessment Value: The taxable assessed value is used to calculate your property taxes (except for exempt farm and partially exempt forest property, which is based on acreage) and, if eligible, will reflect a Capped Assessment.

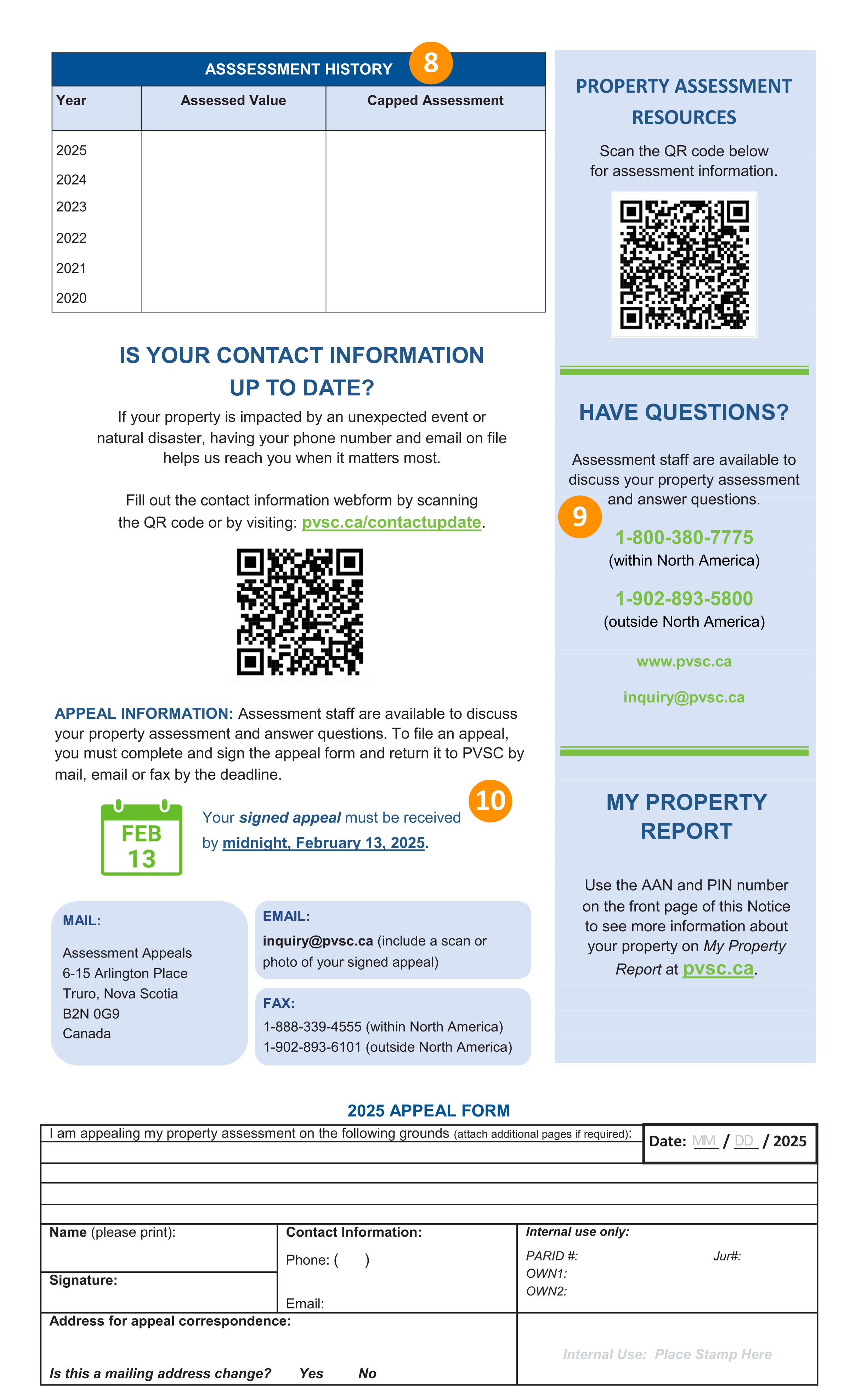

- Assessment History: The assessment history displays five years of assessments, including the Total Assessed Value and the Total Capped Assessment Value.

- PVSC Contact Information: : PVSC Assessors are available to answer questions and discuss assessments by email or phone.

- Appeal Deadline: The deadline to appeal your 2025 property assessment is February 13, 2025. Your signed appeal must be received no later than midnight on February 13, 2025.